Addressing the

affordability crisis

BlueCross BlueShield of Tennessee is here to provide our members with access to quality care at the best possible prices. We recognize that Tennessee employers and our members are facing an affordability crisis, and we’re responding by making changes to address rising health care costs and provide them with much-needed savings.

Affordability matters

Health care costs continue to skyrocket, making life harder for Tennesseans, including our members and the businesses that provide coverage for their employees. BlueCross is taking proactive steps to slow these cost increases, protect coverage and keep care accessible.

Rising costs require action

We’re committed to helping our members get the care they need – but higher prices for drugs and services, rising use of certain services, and inaccurate billing are driving up the cost of insurance for everyone.

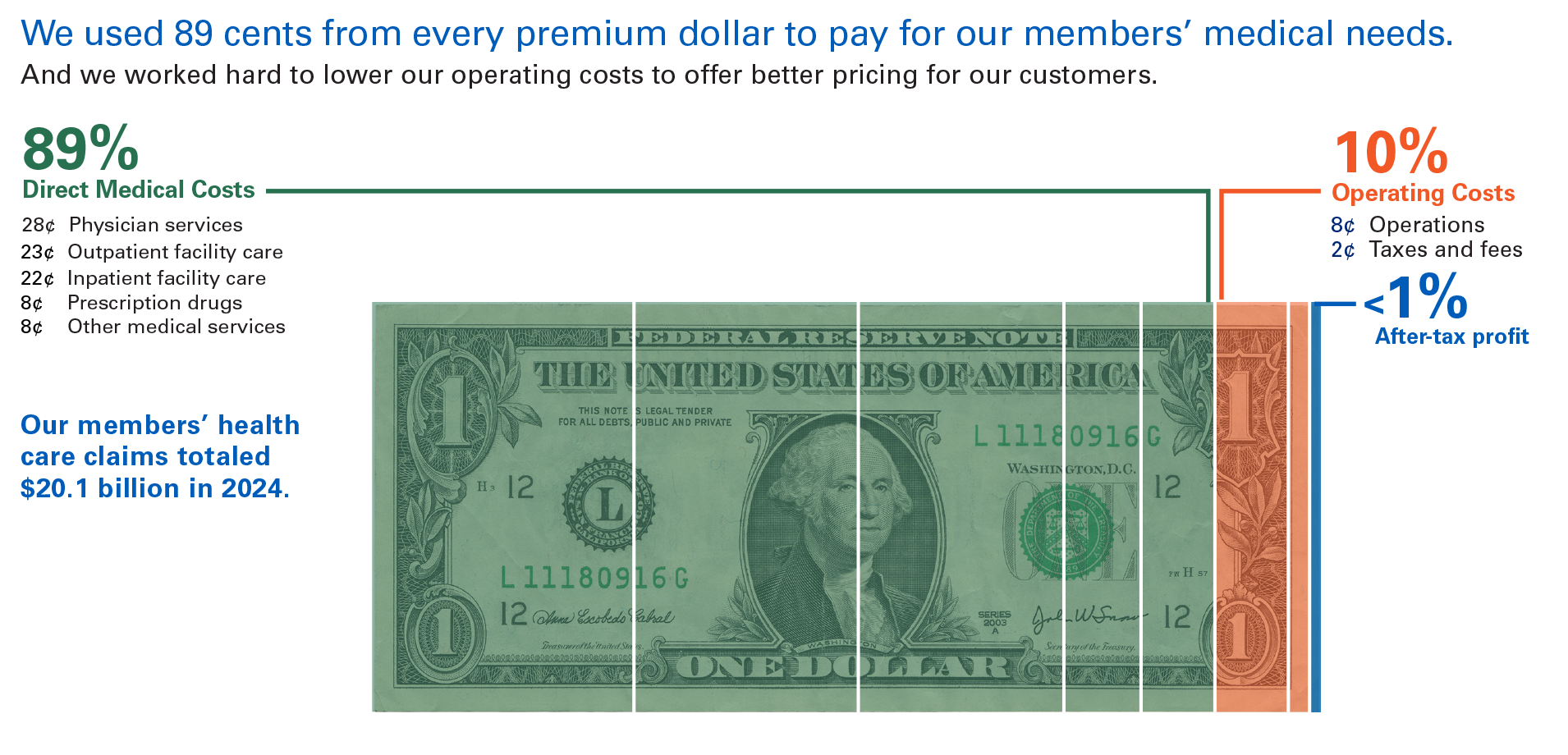

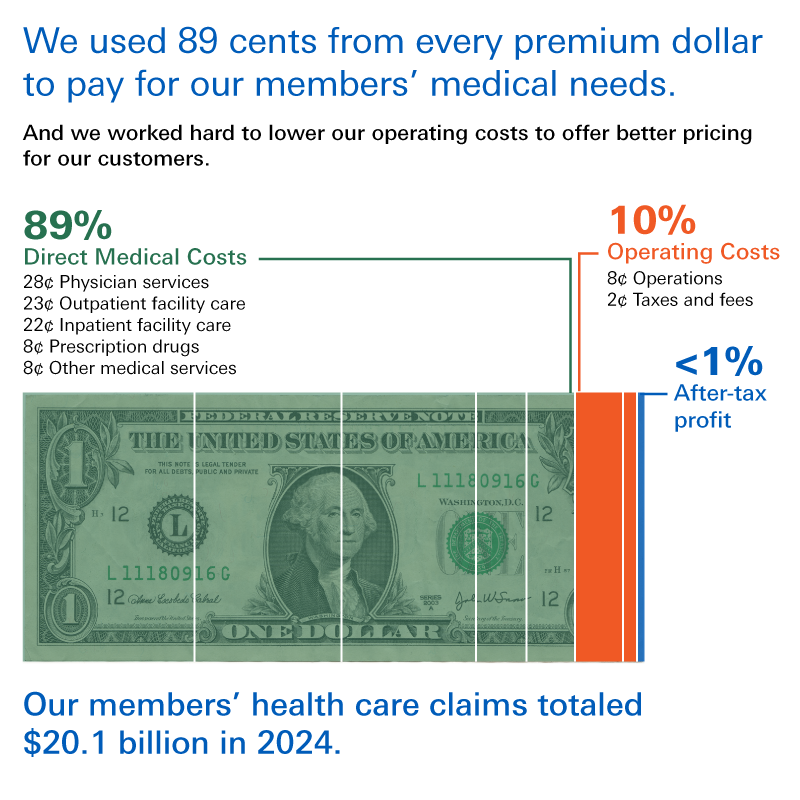

Last year, we paid out a record $20.1 billion in claims on behalf of our members and customers. This marks the second year of record claims costs, topping the previous record of $17.81 billion set in 2023. That trend can’t continue.

We’re making changes to address rising health care costs and keep care as affordable as possible for the customers and members we serve, including adjustments to claims reviews, lowering drug and lab costs, and more. Learn more about what we’re doing.

Drivers of rising costs

Insurance costs are always based on what we have to pay for the medical care and medications our members need.

The big picture includes a number of factors, including the overall health and well-being of members, the cost and quality of inpatient and outpatient care, and unregulated drug prices that are set by prescription drug companies.

A number of factors are driving up the cost of care for Tennesseans, including:

Increasing medical costs and use of services

Health care costs are at record highs. They rose much faster than expected in the second half of 2024 and continued to rise throughout 2025. Pricing for everything from prescriptions and hospital stays to procedures, equipment and services has gone up. And more people are using certain services than ever before. For example, knee replacement surgeries increased by over 45% from 2021 to 2024.

Surging drug prices

- •Drug prices have consistently outpaced general inflation. Since 1985, overall drug prices have risen at rates three times faster than inflation. By 2024, drug prices were more than 127% higher compared to the cost of all other commodities.

- •Drug companies spend billions of dollars every year on advertising and promotion, which drives up the use of already-pricey treatments.

Where does your money go?